However, this bullet-proofing can make it difficult if you are seeking credit. (However, Equifax is providing free credit monitoring in the wake of its breach for one year to potential victims.) Freezing can make mortgage application a challenge It’s also often cheaper than credit monitoring services, which require ongoing payments.

If creditors don’t have access to your credit information, they are unlikely to grant you (or anyone pretending to be you) credit. The main advantage of a credit freeze is that it’s pretty much bullet-proof. It’s important to understand that freezing your credit does NOT prevent identity theft - if someone has information about your existing credit cards or bank accounts, it won’t prevent them from accessing them.

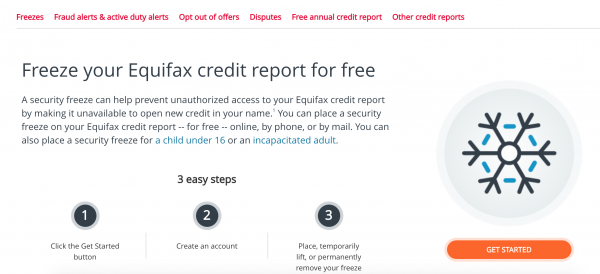

#Remove credit freeze equifax for free

However, Equifax claims that enrolling in the free credit monitoring service they are providing victims of its data breach allows you to freeze your credit for free if you want. It typically costs about $30 to set up a freeze.

This keeps identity thieves from using your information to open up new accounts in your name. Once you implement a credit freeze, lenders and other companies cannot see it. If you have a problem managing debt, credit counselors may advise you to actually put your credit cards under water and then in the freezer, encasing them in ice to prevent impulse buys.įreezing credit, also known as placing a security freeze, locks up your credit report.

That can prevent people from opening up accounts in your name, but what if you’re shopping for a mortgage? What exactly is “freezing” your credit? If your personal data is no longer secure because of the recent Equifax hack, many personal finance experts recommend that you protect yourself with credit monitoring and even freezing your credit. Septem4 min read Equifax leak: experts recommend freezing your credit

0 kommentar(er)

0 kommentar(er)